The author or authors usually do not possess shares in any securities talked about in this article. Learn about Morningstar’s editorial insurance policies.

Stock value graph illustrating the 2020 stock market crash, demonstrating a sharp fall in stock rate, accompanied by a recovery A stock market crash is actually a social phenomenon in which exterior economic functions combine with crowd psychology in a beneficial feed-back loop where by offering by some market participants drives extra market individuals to offer. Most of the time, crashes generally arise less than the subsequent situations: a chronic period of mounting stock price ranges (a bull market) and too much economic optimism, a market wherever rate–earnings ratios exceed extensive-term averages, and intensive use of margin debt and leverage by market individuals.

You should speak to your broker or money agent to validate pricing before executing any trades. Find out more

Based upon the concept a cooling-off period of time would enable dissipate worry advertising, these necessary market shutdowns are activated Anytime a substantial pre-outlined market decrease happens through the buying and selling day.

The stock market not merely cannot discover its footing in 2025, but It is also in danger of losing its grip altogether.

Similar to the Swiss Market Index (SMI), the Dow Jones is usually a cost index. The shares included in it are weighted As outlined by price tag; the index level signifies the standard from the shares included in it. Dividend payments are usually not viewed as in the index.

The period's hallmark was its virtually unfettered speculation. Stock manipulation schemes flourished overtly—from coordinated buying and selling swimming pools to synthetic "clean gross sales" created to make the illusion of market exercise.

Inside the chart beneath, Each individual bear-market episode is indicated by using a horizontal line, which starts off at the episode’s peak cumulative worth and ends if the cumulative benefit recovers towards the earlier peak.

The Wall Road Crash of 1929 During the minds of many Us citizens, the crash of 1929 is the paradigm circumstance of the market disaster. Possibly it absolutely was the rise of mass media during the early 20th century (nationwide newspapers and wire products and services, radio), the horrible melancholy that adopted, or maybe the adjustments that it at last triggered, the crash of 1929 is one that is taught quite possibly the most in U.S. schools and one that a lot of Us residents have some familiarity with.

The 5% threshold may use over again just before transactions are halted For the remainder of the day. When this kind of suspension occurs, transactions on selections determined by the underlying protection can also stock market crash be suspended. Additional, when stocks symbolizing greater than 35% with the capitalization from the CAC40 Index are halted, the calculation from the CAC40 Index is suspended as well as index is replaced by a pattern indicator. When stocks symbolizing less than 25% with the capitalization of your CAC40 Index are halted, trading to the spinoff markets are suspended for 50 percent an hour or so or one hour, and extra margin deposits are asked for.

How will you evaluate a market crash’s severity? That’s what Kaplan’s “ache index” steps. This framework considers each the degree with the decline and how long it took to acquire again to the prior amount of cumulative benefit.

Plunge Defense Markets can also be stabilized by big entities paying for huge portions of stocks, fundamentally setting an illustration for individual traders and curbing panic marketing. In one renowned case in point, the Panic of 1907, a 50% fall in stocks in New York set off a economic worry that threatened to bring down the fiscal procedure.

Secretary in the Treasury Alexander Hamilton cajoled numerous banking institutions into supplying special discounts to All those needing credit history in numerous metropolitan areas, Along with employing many insurance policies and other measures to stabilize U.S. markets.

The slide was induced by worries about growing curiosity charges and rising skepticism about stock valuations, which had amplified noticeably in the bull market of your late fifties and early sixties.

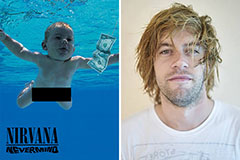

Spencer Elden Then & Now!

Spencer Elden Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now!